In this blog, I’ll walk you through essential strategies on how to avoid a nursing home taking your house, from Medicaid planning to legal asset protection, so you can secure both your home and financial future.

The thought of losing a cherished family home to nursing home costs is a concern for many individuals and families. Long-term care expenses can quickly add up, and without the right precautions, Medicaid may require you to use your home to cover these costs.

Don’t worry—there are ways to protect your property and ensure it remains in your family.

10 Ways to Protect Your Home From Being Taken

Here are 10 ways to protect your home from being taken by a nursing home due to long-term care costs:

1. Medicaid Asset Protection Trust (MAPT)

MAPT allows you to transfer your home into an irrevocable trust, protecting it from nursing home costs while ensuring you can still live in it. However, since it’s irrevocable, you give up direct ownership, meaning you can’t sell or refinance the home without the trustee’s approval.

The key benefit is that after the five-year Medicaid look-back period, the home won’t be counted as an asset when determining Medicaid eligibility. This prevents it from being used to cover long-term care expenses, keeping it safe for your heirs.

By planning ahead and setting up a MAPT early, you ensure your home stays in your family rather than being lost to nursing home costs. It’s a powerful way to secure your legacy while still preparing for potential long-term care needs.

2. Life Estate Deed

A Life Estate Deed lets you live in your home for life while ensuring ownership automatically transfers to your heirs upon your passing, protecting it from Medicaid estate recovery. This arrangement bypasses probate, keeping your home out of Medicaid’s reach.

You retain full rights to occupy and maintain the home, but you’ll need your heirs’ consent to sell or refinance it. Since the home is no longer part of your estate at death, Medicaid cannot claim it to recover long-term care costs.

With a Life Estate Deed, you secure your home’s future for your loved ones while maintaining the right to live in it—giving you both protection and peace of mind.

3. Transfer Ownership to a Spouse

If one spouse enters a nursing home, transferring the home to the healthy spouse (community spouse) can shield it from Medicaid estate recovery. Since Medicaid exempts a primary residence if a spouse still lives there, this ensures the home stays protected.

Unlike other asset transfers, spousal transfers are not subject to Medicaid’s five-year look-back period, meaning they can be done without penalties. This prevents Medicaid from claiming the home after the institutionalized spouse passes.

By taking this step, you secure your home for your family while ensuring the community spouse retains full ownership and financial stability.

4. Use the Medicaid Caregiver Exemption

If an adult child has lived with you and provided care for at least two years before you enter a nursing home, you can transfer your home to them without penalty under the Medicaid Caregiver Exemption.

Unlike typical asset transfers that trigger Medicaid’s five-year look-back period, this exemption allows a home transfer if the child’s care helped delay nursing home placement. Proper documentation may be required to qualify.

This strategy protects your home from Medicaid estate recovery while ensuring it stays with a loved one who has supported you, securing both their future and your legacy.

5. Purchase Long-Term Care Insurance

Long-term care insurance helps cover nursing home costs, reducing reliance on Medicaid and protecting your home and savings from being used for care expenses.

A good policy allows you to pay for care on your terms, whether at home or in a facility, without risking financial security. Buying coverage early makes it more affordable.

With long-term care insurance, you ensure quality care while safeguarding your assets and easing the financial burden on your loved ones.

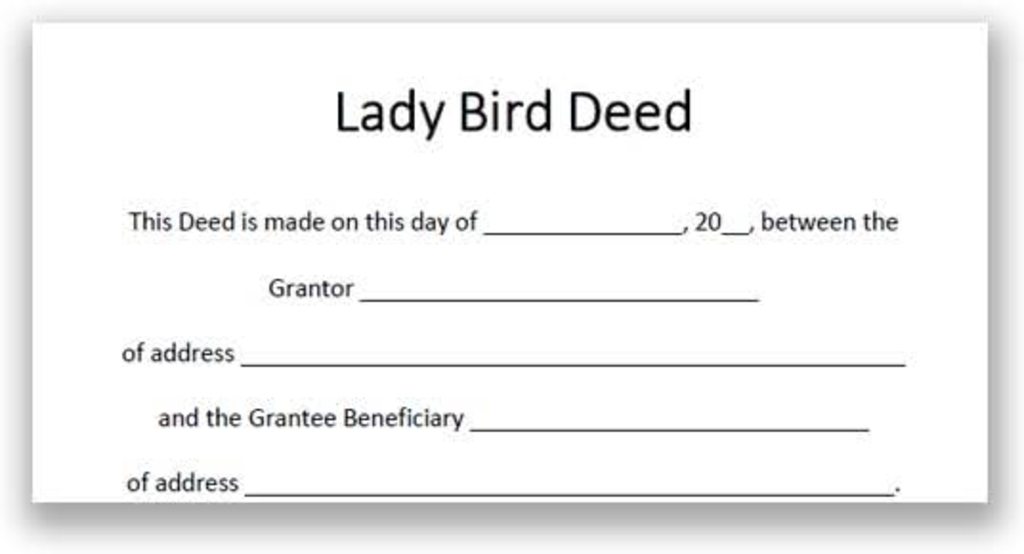

6. Consider a Lady Bird Deed

A Lady Bird Deed lets you retain full control of your home while ensuring it automatically transfers to your heirs upon your passing—bypassing probate and avoiding Medicaid estate recovery.

Unlike a traditional life estate deed, it allows you to sell, refinance, or change beneficiaries without approval. Since the home isn’t part of your probate estate, Medicaid cannot claim it after your death.

This deed offers flexibility and protection, letting you secure your home’s future while maintaining complete ownership during your lifetime.

7. Create a Family Limited Partnership (FLP) or LLC

You can place your home in an FLP or LLC and remove it from your personal assets, shielding it from Medicaid estate recovery while still allowing some control.

An FLP lets you retain a managing interest while gradually transferring ownership to family, while an LLC provides flexibility and liability protection.

This approach keeps your home in the family, reduces estate risks, and ensures long-term asset protection.

8. Spend Down Assets Strategically

Since Medicaid has strict asset limits, you can “spend down” assets on exempt expenses like home improvements, medical needs, or paying off debts to qualify without penalties.

Instead of gifting assets, you might upgrade your home, purchase a Medicaid-compliant annuity, or cover prepaid expenses, reducing countable assets legally.

Consulting an elder law attorney ensures you follow the right strategies, protecting your home while securing Medicaid eligibility.

9. Homestead Exemption Protections

In some states, a homestead exemption prevents Medicaid from forcing the sale of your home, making it an exempt asset from estate recovery.

Eligibility rules vary, with some states protecting homes for spouses, disabled children, or dependents. Checking local laws ensures you maximize this protection.

By leveraging homestead exemption laws, you can keep your home in the family and avoid Medicaid claims after your passing.

10. Consult an Elder Law Attorney

Medicaid rules are complex, and an elder law attorney can help you navigate legal strategies to protect your home while ensuring eligibility.

They provide expert advice on trusts, deeds, spend-down strategies, and exemptions, preventing costly mistakes that could put your assets at risk.

With personalized legal protection, you can secure your home and financial future, ensuring your family’s peace of mind.

Can a Nursing Home Claim Your Home?

Yes, in certain situations, a nursing home can place a claim on your home to recover Medicaid costs, but this depends on factors like ownership, exemptions, and estate recovery rules. Proper planning, such as trusts, deeds, and spousal transfers, can help protect your home from being taken.

How Far Back Can a Nursing Home Claim Your Home?

A nursing home, through Medicaid estate recovery, can typically claim your home based on Medicaid’s five-year look-back period. This means any asset transfers within five years before applying for Medicaid may be scrutinized, potentially affecting eligibility and recovery efforts. Proper planning can help protect your home from claims.

What Are My Options to Cover Nursing Home Costs?

You can pay for nursing home care using personal savings, long-term care insurance, Medicaid, Medicare (for limited stays), veterans’ benefits, or assets like annuities and reverse mortgages.You can also consult a financial planner or elder law attorney to help you choose the best option while protecting your assets.

Conclusion

With careful planning, you can protect your home from nursing home claims using strategies like trusts, life estate deeds, and Medicaid exemptions. Since laws vary, consulting an elder law attorney ensures you make the best decisions. Taking action now helps preserve your assets, secure your legacy, and bring peace of mind.